what percent is taken out of paycheck for taxes in massachusetts

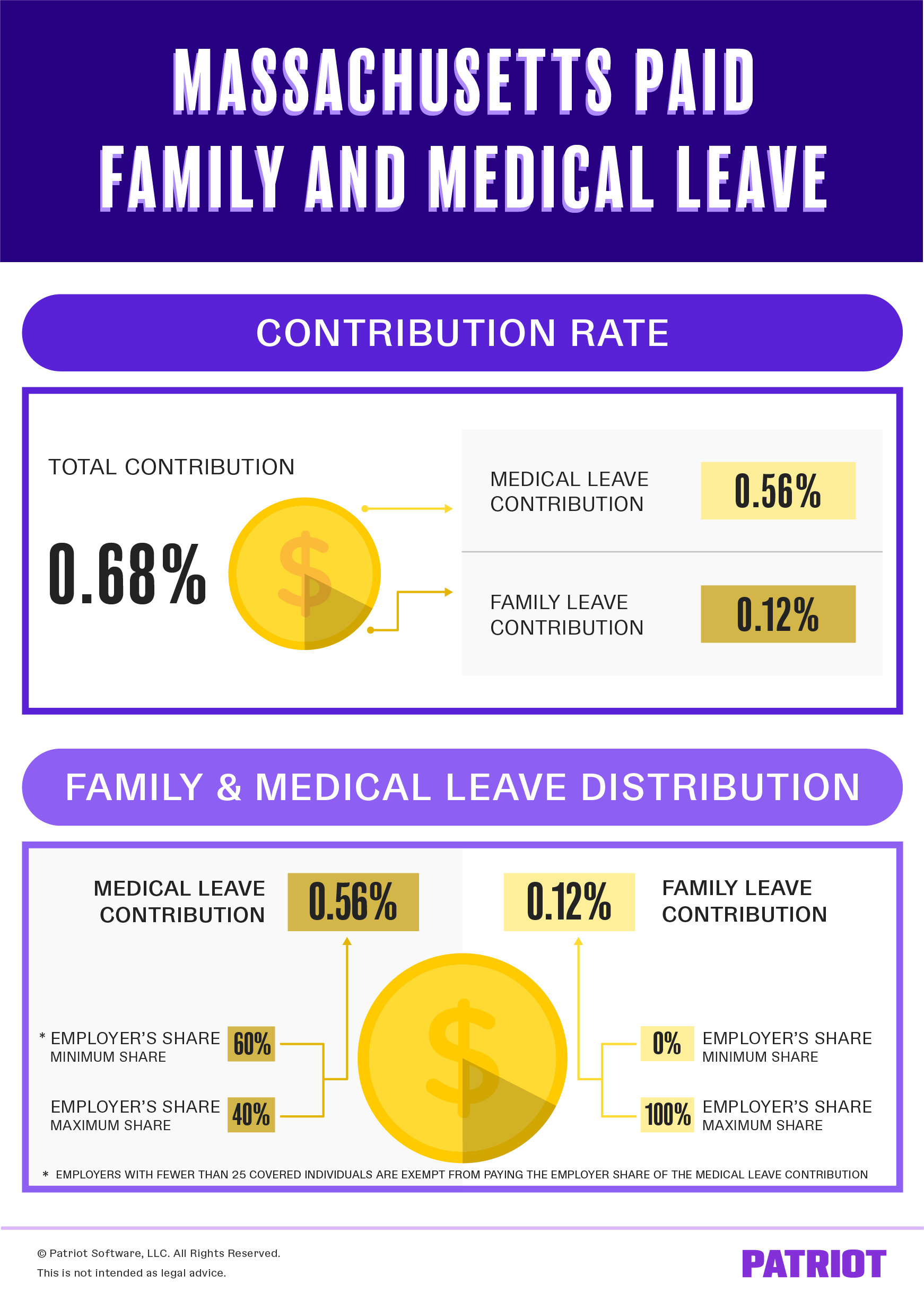

How much is being taken out of my paycheck for PFML. Note that you can claim a tax credit of up to 54 for paying your Massachusetts.

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

What percent of paycheck goes to taxes in Massachusetts.

. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. A state excise tax. You pay unemployment tax.

How much do you make after taxes in Massachusetts. A single filer will. Maximum Tax Rate for 2021 is 631 percent.

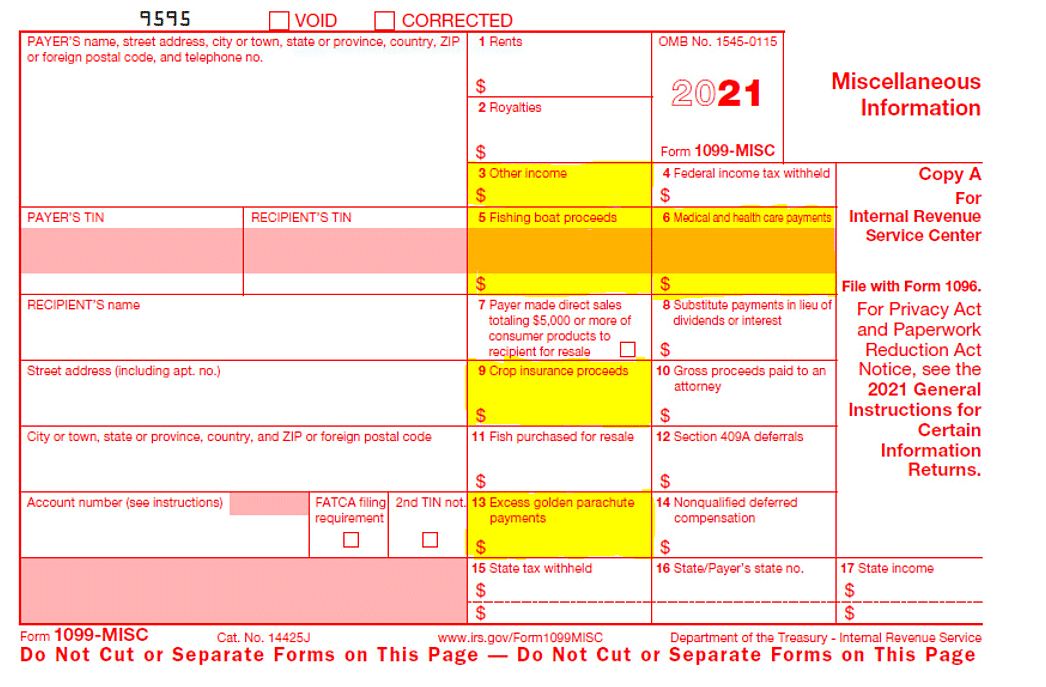

Annually that amounts to. Total income taxes paid. The amount of federal and Massachusetts income tax withheld for the prior year.

The first 15000 of an employees earnings each year is taxable for unemployment insurance. A state sales tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Rates for 2022 are between 094 and 1437. Where Do Americans Get Their Financial Advice. Total income taxes paid.

Just enter the wages tax. Massachusetts Hourly Paycheck Calculator. How much do they take out for taxes in Massachusetts.

There are no tax brackets in Massachusetts. Is mass tax exempt. For every 100 you earn a maximum of 38 cents will be deducted for PFML.

Rates are generally determined by legislation. My pay is 63020 per. Massachusetts is a flat tax state.

Supports hourly salary income and multiple pay frequencies. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. A local option for cities or towns.

This rate is applied to all taxable income in the same way. Toll-free in Massachusetts 800 392-6089 9 am4 pm Monday through Friday more contact info Changes to IRS Form W-4 as of January 1 2020 Prior to the enactment in. Minimum Tax Rate for 2021 is 031 percent.

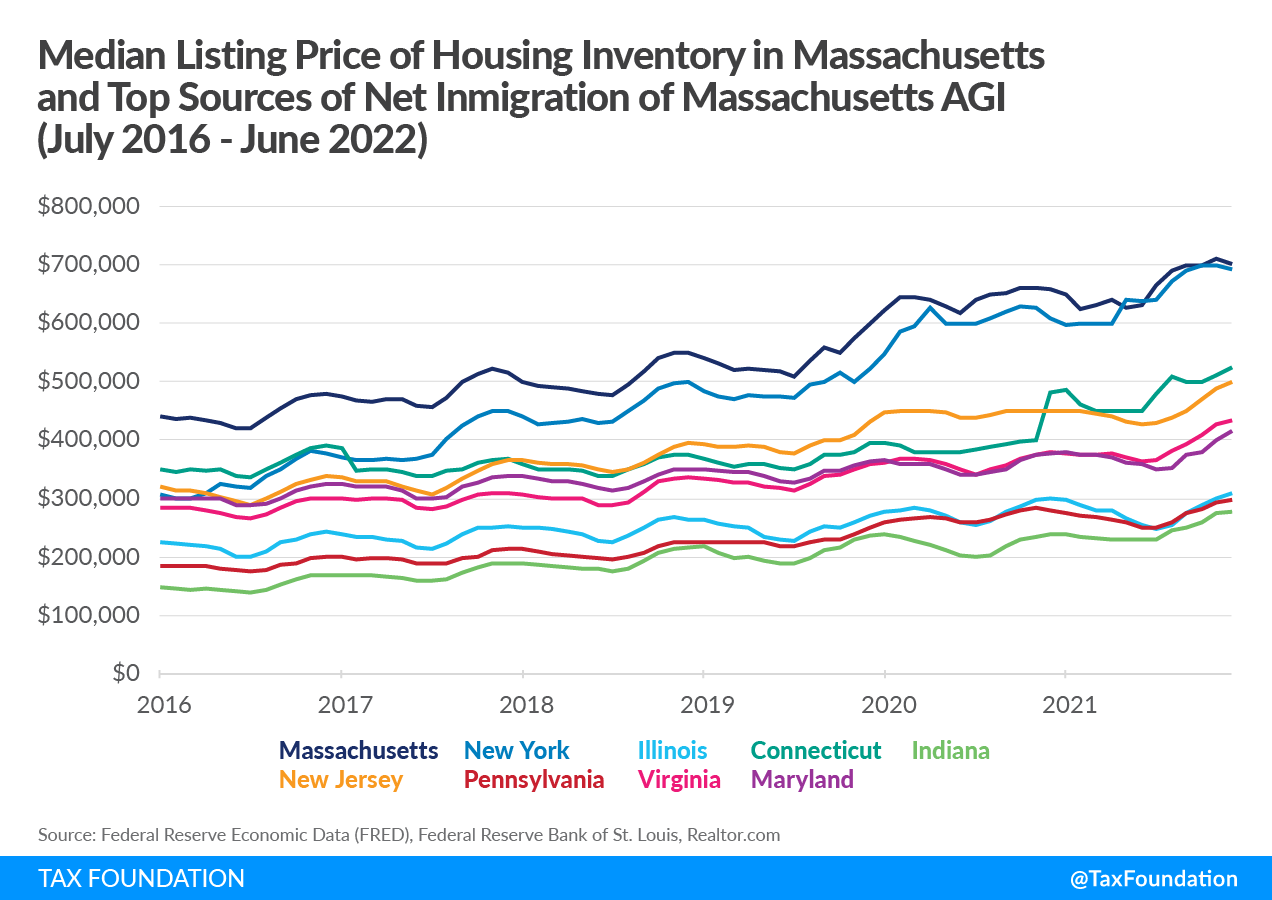

Income Taxes in Massachusetts Massachusetts has a 500 percent income tax rate. The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5. For tax year 2021 Massachusetts has a 50tax on both earned salaries wages tips commissions.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Amount taken out of an average biweekly paycheck.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. What taxes are taken out of a paycheck in Texas 2021. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Massachusetts Couples Pay The Highest Percentage Of Income In Taxes In The Country Report Says

Massachusetts Paycheck Calculator Tax Year 2022

Here S How Much Money You Take Home From A 75 000 Salary

A Guide To Estate Taxes Mass Gov

State Income Tax Rates And Brackets 2021 Tax Foundation

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Massachusetts Paid Family Leave Rates Start Dates More

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

How Are Bonuses Taxed In Massachusetts

How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Massachusetts Salary Calculator 2022 Icalculator

Taxes Guidelines For Handling Bonus Pay Managing Your Money Boston Com

Massachusetts Graduated Income Tax Amendment Details Analysis

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much Should I Save For 1099 Taxes Free Self Employment Calculator